Sign up for our daily newsletter

Latest news, reviews, analysis and opinion, plus unmissable deals for bunkered subscriptions, events, and our commercial partners.

A shrug of the shoulders. Unreturned phone calls. Contact details for somebody who “can probably tell you more than I can”. Attempts to initiate a conversation about gWest, the Mary Celeste of Scottish golf, typically elicit one of these responses.

Those who do speak tend to do so on the condition of anonymity. “I didn’t tell you this” and “Between you and I”. You hear a lot of both.

All of which is rather odd when you consider the context: straightforward, innocent questions about the current state of a long-mooted golf development in the geographical heartland of Scotland.

A conspiratorial probe into the affairs of a prominent politician this ain’t.

Consequently, you become two things: exasperated and curious.

Why the reticence, the secrecy, the hush? What is it we’re not meant to know. More importantly, why?

Why is it that gWest continues to hide in plain sight, existing in a microcosm, unplayed and unseen by the overwhelming majority of the country’s golfers?

What you’re about to read should help to answer some of those questions.

* * *

TO FULLY UNDERSTAND the story of gWest, you need to travel back to 1960s Dubai.

It was around this time that the Gulf state – then ruled by Sheikh Rashid bin Saeed Al Maktoum – made a pleasant discovery. Dubai was, quite literally, sitting on a fortune courtesy of vast oil fields flowing deep beneath its hot, desert surface.

• Tadd Fujikawa: Coming out and playing through

Just one problem.

It lacked both the expertise and the tools required to extract this black, liquid gold from the ground.

To circumnavigate this issue, Al Maktoum reportedly dispatched Mahdi Al Tajir, the head of his customs department and one of his closest advisors, to ask neighbouring Iran for assistance.

The deal Al Tajir ultimately brokered resulted in Iran helping Dubai get off the starting blocks in its lucrative oil rush. In return for his negotiation skills, Al Tajir is said to have been given a percentage of all of Dubai’s oil revenues. Almost at a stroke, his net worth multiplied exponentially.

Over time, Al Tajir expanded his portfolio to include an array of properties, including London’s Sheraton Park Tower Hotel and Mereworth Castle in Kent. In 1975, he paid £2m – approximately £15m in today’s money – for Keir House and its sprawling estate in Perthshire. Four years later, he founded bottled water brand Highland Spring in nearby Blackford.

He subsequently bought up most of the land surrounding the company’s headquarters. This gave him have complete control over the water supply coming from the Ochil Hills and, in turn, make Highland Spring certifiably organic.

Along the way, Highland Spring acquired several other rival water companies, including: the Gleneagles Spring Water Company, also based in Blackford, in 2001; the Speyside Glenlivet Water Company in 2009; and Campsie Spring in 2010.

In 2013, Highland Spring sold 200m litres of bottled water, pushing Evian into second place in the race to be the UK’s most popular bottled water brand – the first time a British company had held that distinction.

All of this earned saw Al Tajir christened ‘Mohammed of the Glens’ by Scottish tabloids. Rather more significantly, he has also become one of the country’s richest men, with a fortune exceeding £1.65bn.

Notoriously media-shy, little is known about Al Tajir’s non-business interests, with the exception of a declared taste for – and extensive collection of – silver artefacts, pearls and Persian carpets. In 1993, he reportedly paid a world record sum for a piece of silver, when he spent close to £2.3m on a 1736 chandelier made by Balthasar Friedrich Behrens at an auction in Monaco.

For a man inexorably linked to oil, water and silver, there’s an amusing irony in most of Al Tajir’s business interests having turned to gold.

The gWest International Resort is a notable exception to that rule.

• Golf’s silent killer – and how to fight it

* * *

TO BE LOCATED immediately next door to the Gleneagles resort, the plans for gWest were unveiled in 2007.

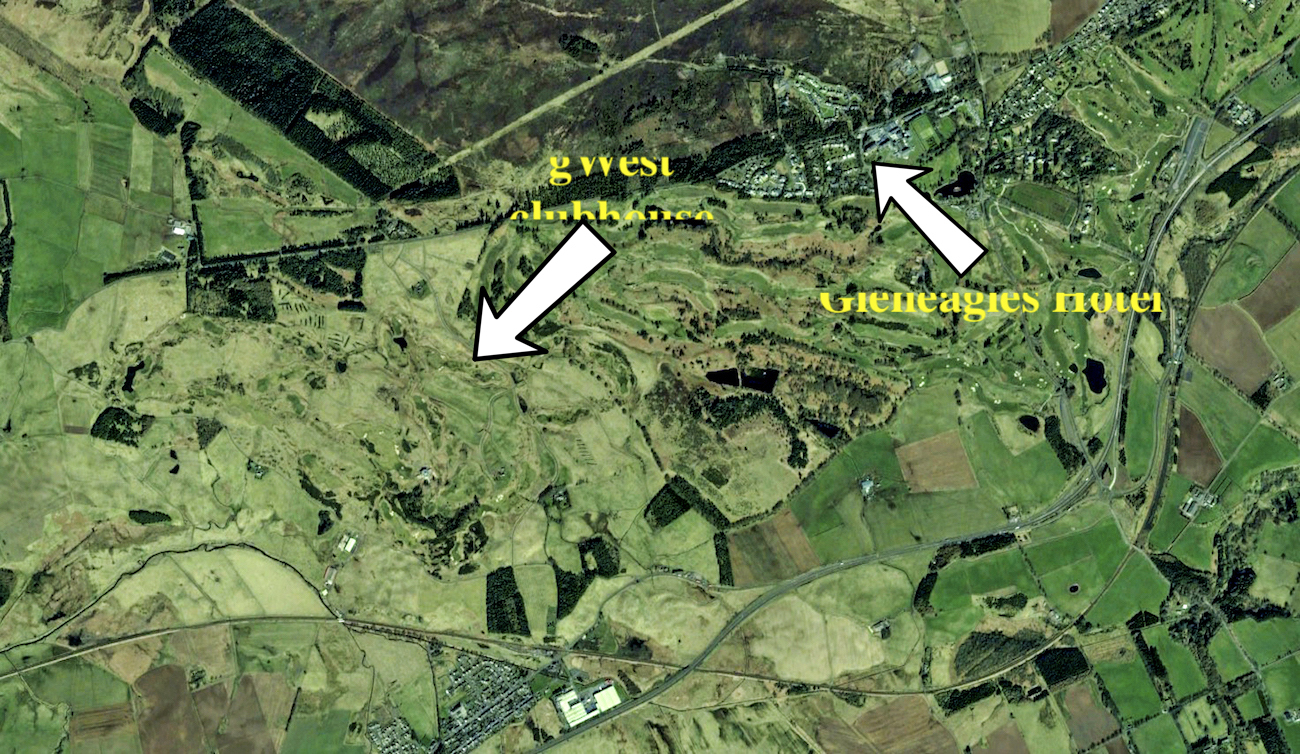

The intention was ambitious but simple: to create an ultra-exclusive, private community in the heart of Perthshire. The estate was to occupy more than 620 acres of the countryside, and extend 2.3 miles from east to west. gWest was just its working title. It was technical shorthand for ‘Gleneagles West’. The likelihood was (and reportedly remains) that it would be rechristened for its grand opening.

Original planning documents gave Al Tajir and his family, led by his sons Mohsin and Maher, the right to build 170 new homes on the site. It would be followed, in quick measure, by a small, boutique hotel offering world-class dining, a destination spa, and leisure and entertainment facilities.

The estate – bounded, in the main, by land also owned by the Al Tajirs – was to be gated with its own security staff. To elevate its intimacy, it was agreed that an additional 120,000 trees would be planted throughout the estate. Imagine a heather-clad, slightly colder version of Isleworth – the Florida community that Tiger Woods used to live in – and you get the picture.

The grand centerpiece of it all was to be an 18-hole championship golf course, built for the estate’s property owners and their guests, and designed by Scottish course architect David McLay-Kidd.

Having recently completed the Castle Course – the seventh course in the St Andrews Links portfolio – Kidd’s stock was high. At the time, he remarked that the piece of land he was given to work with at gWest was “without question, the best inland site I have ever seen for a golf course”.

Everything started so positively. Then, in 2008, the world’s markets collapsed, prompting a global economic downturn.

According to a source I spoke to, this resulted in a strategic pivot at gWest.

With the world’s property markets flatlining, plans to sell the 170 property plots (some as large as four acres in size and with seven-figure price tags) were placed on hold indefinitely. The construction of the course, however, proceeded largely as planned and, by 2009, it was complete.

In 2012, construction of the adjoining clubhouse was completed. Its interior still had to be finished but, from a ‘build’ standpoint, it was wind and watertight. On the point of the clubhouse, it’s worth addressing a mistake many people have made about it. It has been said by those who have seen it (and you can glimpse it from the A9 between Perth and Stirling) that it ‘looks like a mosque’. It was, in fact, built as a homage to Mereworth Castle, a Grade I listed Palladian country house in Kent, designed by 18th century Scottish architect Colen Campbell, and owned by Mahdi Al Tajir.

With the course and clubhouse ready by the start of 2013, and the world returning to economic stability, the decision was taken to start selling the property plots with a view to launching the resort properly around the time of the 2014 Ryder Cup at neighbouring Gleneagles.

Sales agents were appointed, a strategy was developed and, in early 2013, a group comprising 64 of Scotland’s foremost business people were invited to play the course.

They delivered ‘glowing’ feedback and, for a time, it appeared as though the gWest dream was finally close to being realised.

But that’s the trouble with dreams. More often than not, you wake from them.

* * *

TOWARDS THE END of summer 2013, the sales agents reportedly requested a meeting with the team at gWest. They had encountered a problem.

A big problem.

None of their prospective buyers were biting. In fact, never mind biting, they didn’t have so much as a nibble of interest to report.

The reason? Politics. At the time, Scotland was just over a year from an independence referendum that posed the prospect of major constitutional and political reform.

It’s believed that gWest hoped to attract most of its investment from the overseas market. However, with a cloud of uncertainty hanging over Scotland, prospective buyers weren’t prepared to take unnecessary risks.

“For example, they wanted to know what an independent Scotland’s currency would be,” a source told me. “Would it be the Scottish pound, the Euro, the Scottish dollar, the Scottish dirham? Nobody knew and nobody could give them the answers they wanted.

“They also wanted to know what the tax implications would be. How many days would they be able to spend in Scotland before handing over large chunks of their incomes to the taxman, stuff like that. Again, nobody could tell them definitively what that would be, so they pulled back.”

The Scottish public ultimately voted in September 2014 to remain part of the United Kingdom – but the outcome of the referendum posed more questions than gWest was in a position to answer.

“With the result of the vote being so close, if you recall, extra powers were supposed to be devolved to the Scottish Parliament,” added the source. “That created even more buyer uncertainty. What would those powers be? When would they be devolved? Instead of being reassured by the vote, the market remained wary, and certainly too wary to commit to investing.”

It is my understanding that mothballing the whole development was seriously contemplated before the storm clouds started to dissipate. They then gathered again, as yet another referendum – Brexit – impacted on buyer confidence.

Within weeks of the UK voting to leave the European Union, gWest appeared to go on the offensive. In a July 2016 interview with the Daily Record, project director Stuart Davie of Ochil Developments declared that they were “back up and at it.”

Davie is quoted as saying: “We have re-commenced phase one of the project, incorporating completion of the clubhouse and the golf course, the entrance gateway, nearly 6km of roadways and opening up the first 26 plots.”

• Introducing Chase – The ‘Other’ Koepka

In the course of this investigation, I attempted to contact a sales agent listed on the gWest website to establish the current status of the development. They did not return my call but, from what I gather, there’s no rush to complete.

“Every penny spent on gWest so far has been spent by the Al Tajir family,” my source added. “There are no lenders knocking on the door demanding to see a return on their investment, so they are able to sit and let market forces play out.”

In the meantime, the resort’s course lies there, largely untouched. A full-time greens staff tends to it all year round but hardly anybody plays. Even its designer, McLay-Kidd, hasn’t seen it for the last seven or eight years. Now based in Oregon on the west coast of the USA, Kidd had little to say about the layout. “You probably know more about it than I do,” he told me in the course of a brief phone call.

Some, though, have played it. Dean Robertson’s University of Stirling golf team, for example. So, too, Scottish European Tour pros David Drydsale and Peter Whiteford. Interestingly, Henrik Stenson played it several years ago. Previously based in Dubai, Stenson is a friend of Mohsin Al Tajir, who invited him to play during a visit to Scotland.

“Everybody who has played it raves about it,” my source told me. “If they wanted to, they could open it tomorrow and it would soon become one of Scotland’s most popular courses. But they don’t want to. The family has a specific vision for gWest and they have the luxury of being able to wait for the stars to align before pressing on further.”

Which leaves one question: will gWest ever see the light of day? My source is in no doubt.

“I’m sure it will. That, though, could be five years from now, ten years from now, twenty years from now, maybe more.

“It’s a curious case but the family has a long term commitment both to Scotland and to excellence. So, I suspect it will get there. But when? That’s anybody’s guess.”

Until such times, it will remain one of Scottish golf’s most intriguing enigmas; a mystery, wrapped in a riddle, smothered in secrecy and heather.

—

• THIS FEATURE FIRST APPEARED IN ISSUE 164 OF BUNKERED.

Photographs courtesy of Mark Alexander

ALL ABOUT THE MASTERS

More Reads

The bunkered Golf Course Guide - Scotland

Now, with bunkered, you can discover the golf courses Scotland has to offer. Trust us, you will not be disappointed.

Find Courses